Services

Deposit

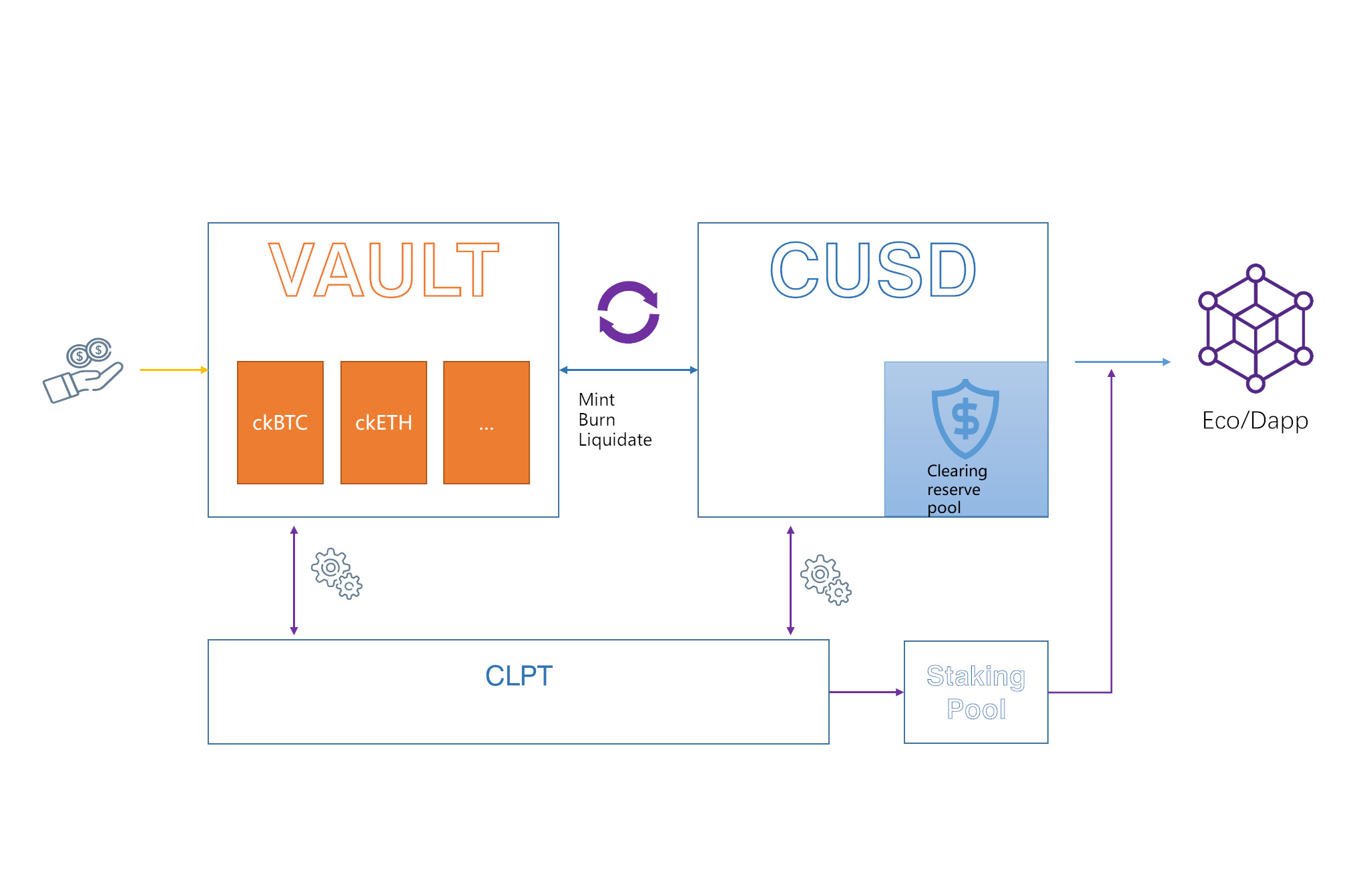

Users can efficiently deposit ckETH or ckBTC into the CLP platform and instantly receive the corresponding CUSD stablecoin. The deposit process is straightforward and efficient, eliminating complex procedures, with real-time calculations of the generated CUSD quantity.

Loan

After depositing a certain amount of ckETH or ckBTC, users can borrow the equivalent value in CUSD. CLP follows a zero-interest lending policy, requiring users to pay a one-time fee, providing a flexible and stress-free borrowing service.

Liquidation

CLP features a liquidity pool for clearing pledged assets, ensuring system stability. Users can earn rewards by providing liquidation services, gaining additional CLPT tokens from the liquidity pool.

CLPT Token

Users participating in liquidation by depositing CUSD into the liquidity pool receive CLPT token rewards. CLPT also serves as a governance token, allowing holders to vote and propose governance changes.

Governance

Users holding CLPT tokens are eligible to participate in CLP governance. They can vote on issues related to platform upgrades, parameter adjustments, and actively engage in shaping the platform's future.

Community

CLP encourages user involvement in community building. Users can actively contribute to the platform's community prosperity by proposing innovative ideas, participating in discussions, and more.

Features

Low-Cost Lending

Utilizing an interest-free lending mechanism, users can access liquidity at a low cost

Seamless Liquidity

CLP provides real-time deposit and withdrawal services, ensuring a smooth user experience. No waiting, convenient, and flexible, making your crypto assets available anytime

Dual-Token Incentives

The dual-token mechanism of CLP allows users to earn additional rewards through mining and liquidation

Rich Tool Support

Offering SDKs and front-end templates to assist ecosystem projects in seamlessly integrating with CLP, expanding the protocol's influence.

Experienced Team

Core team members bring years of experience in traditional finance, DEFI, and decentralized financial derivatives, providing a solid foundation for the protocol's stable development

ICP Ecosystem

Established on the Internet Computer Protocol (ICP), a decentralized financial protocol leveraging the security and scalability of the ICP ecosystem.

Tokenomics

CUSD Stablecoin

- Issuance Mechanism: CUSD is a stablecoin issued based on users pledging ckETH or ckBTC, with its supply directly linked to the value of the collateral pledged by users. Users can obtain CUSD by depositing a certain quantity of ckETH or ckBTC, following the collateralization ratio.

- Zero-Interest Lending: CLP adopts a zero-interest lending policy, enabling users to borrow CUSD without incurring high-interest costs. Users only need to pay a one-time fee, making borrowing services more accessible and economical.

CLPT Token

- Total Supply: The total supply of CLPT is 1 billion tokens, with 20% allocated to sponsors and investment institutions, 10% to the product technical team, and 10% for marketing promotions. The remaining 60% is gradually released to the community through mining rewards.

- Mining Rewards: Users engaging in activities such as deposits, loans, liquidation, and providing liquidity to the liquidity pool have the opportunity to earn CLPT mining rewards. Mining serves as a mechanism to incentivize users to actively contribute to community development and share in the platform's success.

- Community Incentives: A portion of CLPT tokens is allocated for incentivizing community development. Users contributing innovative ideas and actively participating in discussions receive rewards, fostering a healthy and engaged community.

CLPB Runes Token

- Total Supply: The total supply of CLPB is 21,000,000

- Governance Rights: CLPB functions as the governance token of the CLP platform. Holders have the right to participate in governance decisions, including voting for or against proposals, participating in parameter adjustments, allowing for deeper user involvement in the platform's future.

Frequently Asked Questions

Unveiling the CLP Knowledge Hub

-

How does CLP compare to other well-established CDP models in the market?

Diverse Collateral Support: CLP supports ckETH and ckBTC as collateral, providing users with more diverse options and increasing platform flexibility.

Zero-Interest Loans: Unlike traditional CDP models, CLP adopts a zero-interest loan policy, allowing users to borrow CUSD without paying high-interest rates, enhancing the user experience.

CLPT Token Incentives: Users can participate in community building by mining CLPT tokens, fostering a more shared and community-driven ecosystem.

-

How is the security of funds ensured?

Smart Contract Security: CLP utilizes smart contracts from the ICP ecosystem, undergoing multiple security audits to ensure the safety of user funds.

Decentralized Governance: The platform's governance mechanism is decentralized, with votes from CLPT token holders, ensuring fairness and transparency in decision-making.

-

Is KYC required for users?

No KYC Required: CLP platform does not require users to undergo KYC (Know Your Customer) authentication, protecting user privacy while providing more convenient services.

-

What can I expect as returns on CLP platform, and is there a risk of loss?

Returns Depend on the Market: User returns on the CLP platform depend on market conditions and their own participation in platform operations. While the platform strives to provide profitable opportunities, actual returns may vary due to market fluctuations.

Investment Risks: All investments come with certain risks, and users should fully understand and consider their risk tolerance before participating in platform operations.

-

Why choose to develop in the ICP ecosystem instead of the Ethereum ecosystem?

Performance and Scale: The ICP ecosystem offers higher performance and broader scalability, supporting more users and more complex smart contracts.

Low Transaction Costs: Transaction fees on ICP are relatively low, facilitating more economical user operations.

Ecosystem Diversity: The ICP ecosystem is flourishing, providing CLP with more opportunities for collaboration and development, building a richer decentralized financial ecosystem.

-

What is the logic behind zero-interest loans, and how does the platform generate revenue to sustain itself?

Logic of Zero-Interest Loans: Zero-interest loans mean that users borrowing CUSD do not need to pay high-interest rates but only a one-time fee. The platform generates revenue through fees and profits from the liquidity pool.

Platform Profit Mechanism: The platform earns through mining fees, liquidity pool fees, and the execution of governance proposals. Mining and liquidity pool fees come directly from user operations, while the execution of governance proposals relies on the votes of CLPT token holders.

-

Where can I purchase CLPB tokens?

CLPB is officially listed on Fomowell, a leading platform for Bitcoin Rune assets. You can buy CLPB directly through the official listing page: https://btc.fomowell.com/bitcoin/token/51. Ensure you use compatible Bitcoin wallets (e.g., OKX Wallet) for secure transactions.

-

What are the key benefits of holding CLPB?

Holding CLPB grants three core benefits:

(1) Governance rights to propose and vote on key CLP protocol changes, including functional process adjustments and product development directions.

(2) Exclusive privileges of priority access to new CLP features and tiered fee discounts.

(3) Passive value growth via irregular CLPB buybacks and burns, funded by a portion of CLP’s platform revenue.